The aim is to improve and simplify financial rules to suit the UK economy by amending EU law which has been moved to the UK Code and made for a bloc of nations from 28 countries. The Financial Services and Markets Act is more than 300 pages and is the most comprehensive set of financial services reforms since Tony Blair’s Labor government introduced it in 2000, creating significant consumer protections.

The bill ranges from reforms to stock exchange listings and capital market rules to measures to help consumers cope with technological change. Parts of the EU’s extensive MiFID II rules aimed at protecting investors and making financial markets work better are being unraveled, such as the cap on trading in so-called dark pools, or private trading venues, to try to rein in stock trading attract Amsterdam and strengthen London’s business. Looking ahead, certain types of stablecoins, digital assets designed to hold constant value, will be regulated as a means of payment. The bill also introduces a secondary objective for financial regulators, namely promoting economic growth, after their primary objective of ensuring the safety of the financial system.

3. What is the schedule?

The law will be debated extensively in Parliament from September and will be considered in committees of both the House of Commons and the House of Lords. It is scheduled to come into force in April or May 2023. Now that the City of London firms and their lobbyists have seen the wording, they will get to work trying to influence it with the aim of adding some proposals and removing others.

4. How does the race for leadership of the Tory party affect this?

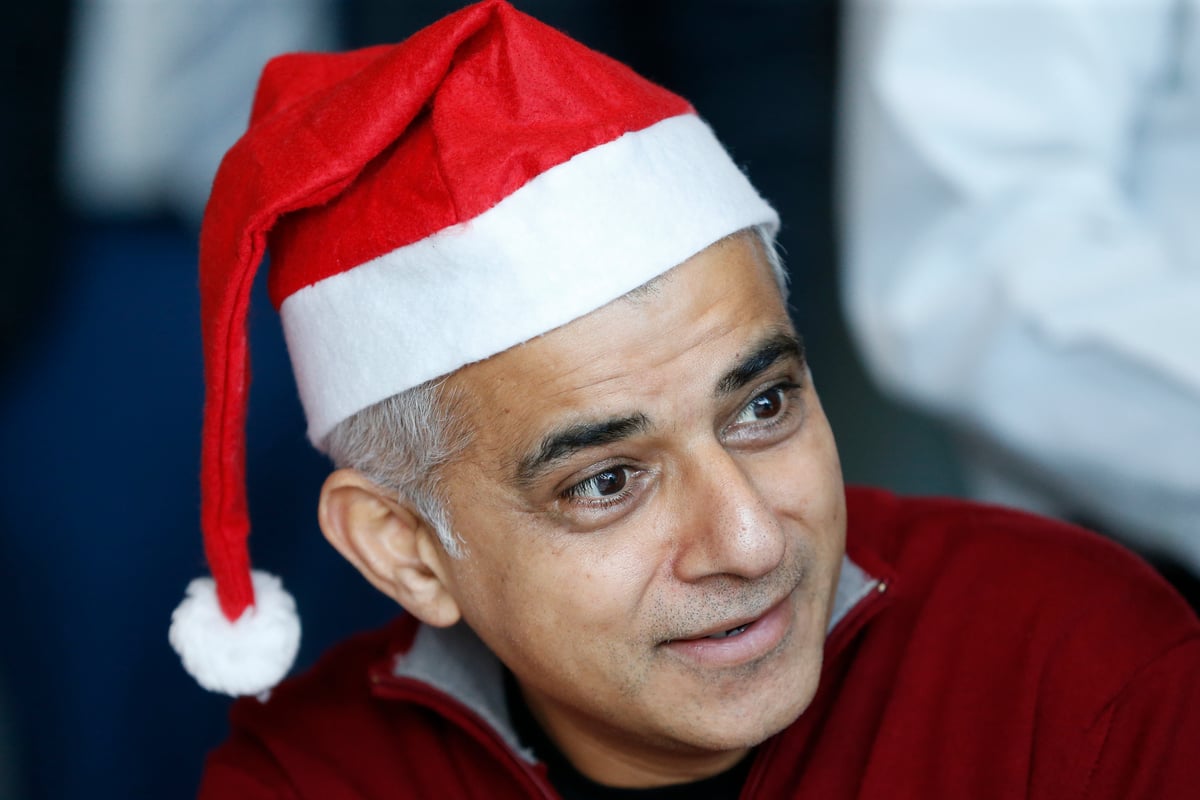

The bill coincides with the Conservative Party voting to choose a new leader who would automatically become prime minister. Liz Truss, the foreign secretary, inaugurated Rishi Sunak, the former finance chancellor, in early August after winning support from the party’s right wing and pro-Brexit supporters. This group is likely to want action to implement their vision for Brexit, including cutting financial bureaucracy and downsizing the state. There could be calls for a less focus on consumer protection and more emphasis on freeing businesses to seek faster growth.

5. How might a new prime minister change the law?

Truss is likely to give ministers the power to overturn some decisions made by financial regulators when she becomes prime minister, a move that could spark fresh tensions with the Bank of England. Truss allies say she favors “call-in” powers to allow the government to block or change the actions of financial regulators, including the central bank’s Prudential Regulation Authority and the Financial Conduct Authority. Their position means that whoever wins the race for leadership supports the mechanism. Sunak argues that such powers are needed to ensure politicians – not “faceless regulators” – are accountable for regulatory decisions. When Nadhim Zahawi replaced Sunak as chancellor in July, he balked at adding “convocation power” to the law, but it could still be added if the law makes its way through parliament.

6. Could this affect the independence of the Bank of England?

At the heart of the convening powers debate is politicians’ attitude towards the BOE, the UK’s chief financial regulator, and the setting of interest rates. The central bank is having a hard time. The government is increasingly critical of its handling of inflation, which could escalate as cost-of-living problems mount. Truss, the secretary of state, has said she wants to reconsider the BOE’s mandate and explore how to ensure policymakers meet their goal of keeping inflation low, sparking a debate over central bank independence.

7. What protection does the BOE have?

There are many people in the world of business, government and finance who believe that the independence of the BOE is vital, both in terms of monetary policy and regulation, among whose responsibilities are consumer protection, competition and security of the financial system belong. Andrew Bailey, the governor of the BOE, has himself warned of the damage the UK’s international reputation could suffer if there were undue permanent violations of the BOE’s freedom of action. His supporters also warn that a dilution of the central bank’s decision-making ability will lead to an inappropriate increase in the power of politicians in regulatory policy and the influence of their financiers.

8. Do regulators need to be regulated?

Even supporters of the BOE recognize that the bill should include some new prudential rules. Because before Brexit, the PRA – the part of the BOE that oversees the financial system – and the FCA, which focuses on consumer protection, worked under the direction of the people democratically elected to the European Parliament. Much of the decision-making shifts to the regulators themselves as part of the transfer from EU rules to UK law. Many MPs, as well as lawyers, economists and industry figures, want some controls to be put in place over undemocratically elected regulators. Ideas range from oversight by lawmakers in the Treasury Select Committee, supported by experts, to an active role for the courts, to more powers for government.

9. How might power be balanced?

There are deep differences of opinion about how the new supervisory powers should be designed and how far they should go. While the government has yet to give itself “convocation power” in the bill, it did include a right to order regulators to conduct a review of their actions, conducted by a third party acceptable to the Treasury. The BOE became independent in 1997. As part of the legislation, the government had the power to intervene in monetary policy in emergencies, but fears that this might happen have been muted due to the risk of resulting market turmoil.

10. What are the probable flash points?

The first battleground between government and regulators is already here. Insurers and some in government want a set of capital rules known as Solvency II liberalized to free up billions of pounds that could be pumped into other investments. They could include infrastructure projects that ministers want to pursue to improve regions outside London and the South East, which was a post-Brexit Conservative pledge. The PRA is ready to reverse some Solvency II rules. But in an area known as the matching adjustment, a calculation that calibrates how well a long-term asset like an infrastructure investment matches a liability like paying annuities, what she really wants is for regulations to get stricter.

11. Could this law have other implications?

A battle with financial regulators could resonate more widely in British society. An agenda to shake things up could include the British Broadcasting Corporation, the state broadcaster set to face a government review by 2024, with questions about its independence likely to be paramount. Its regulator Ofcom could also be in the line of fire, as could the competition and markets regulator, which could become a target for those wanting a boost to rapid growth and less consumer protection.

For more stories like this, visit bloomberg.com

PLC 4ever

PLC 4ever